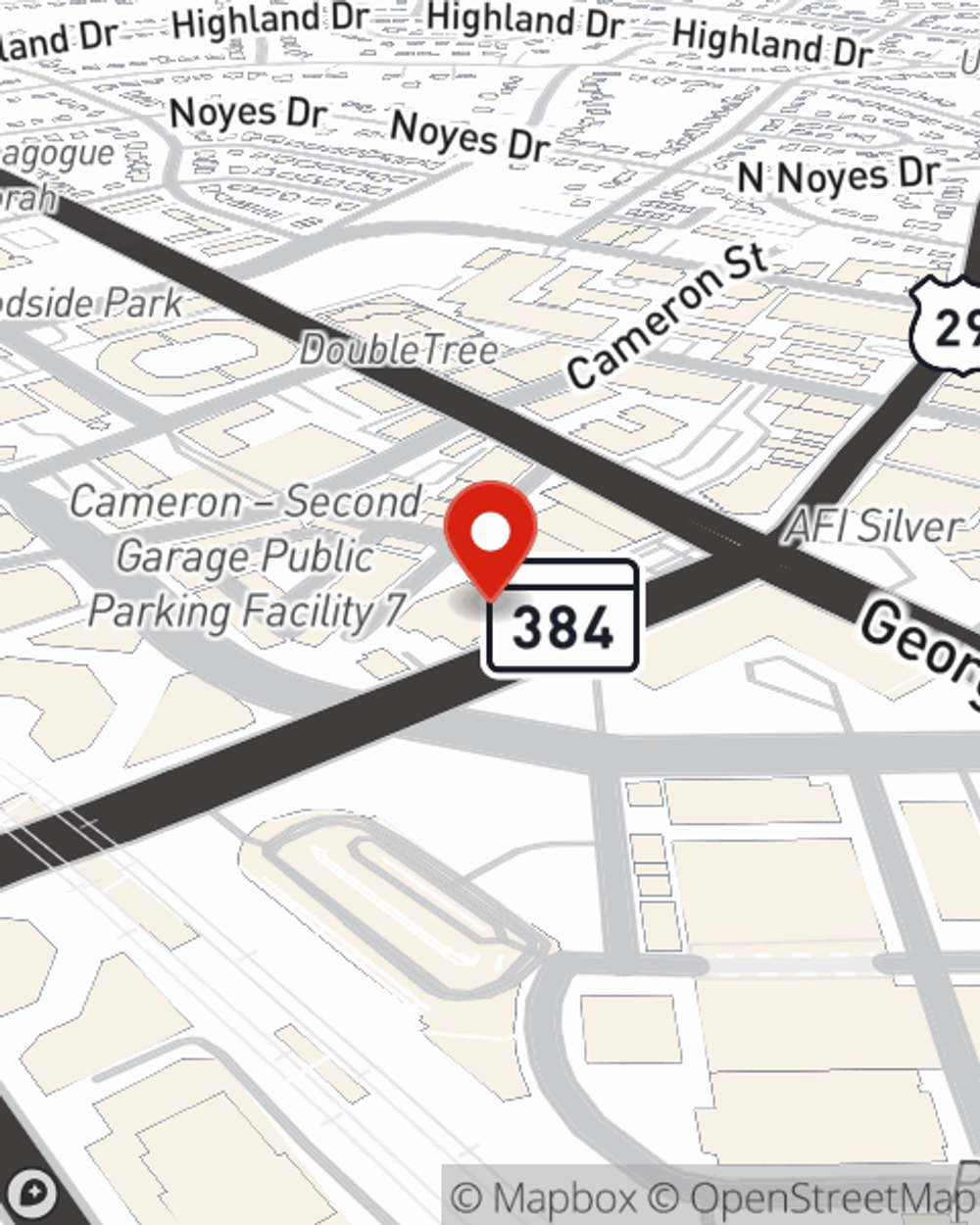

Life Insurance in and around Silver Spring

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

There's a common misconception that Life insurance isn't necessary when you're still young, but even if you are young and a recent college graduate, now could be the right time to start learning about Life insurance.

Protection for those you care about

Now is the right time to think about life insurance

Agent Chris Aguirre, At Your Service

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the level of costs that come with providing for children, life insurance is a definite need for young families. Even for parents who stay home, the costs of replacing before and after school care or domestic responsibilities can be excessive. For those who aren't parents, you may have debts that are cosigned or have other family members whom you help financially.

Did you know that there's now a life insurance option available that's perfect for a person who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be of good use when it comes to paying for final expenses like medical bills or funeral costs. Don't let these expenses be a burden on your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Chris Aguirre and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Chris at (301) 946-4446 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Chris Aguirre

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.